On December 31, in our blog, we remind you of the last day to pay your vehicle token tax. The episode began months back when the Islamabad Excise and Taxation Department issued a strict deadline for vehicle owners to pay their outstanding token tax by December 31, 2024; otherwise, they would face vehicle registration cancellation and fines.

Good News!

In a welcoming move, the department has extended the deadline for 15 days to pay off vehicle token tax in Islamabad. It simply means that January 15, 2024, will be the deadline for the citizenry to comply.

The department has reiterated its warning, stating that failure to pay the tax by the new deadline will result in not only the cancellation of vehicle registration but also a hefty 200% fine.

In another attempt to facilitate taxpayers, the department has also extended office hours at relevant counters to 8 PM daily and encourages the use of the Islamabad City App for smart card holders.

This decision to extend the deadline comes amidst a rising number of defaulters. The department has observed that previous penalties, while imposed, have not been effective in encouraging timely tax payments. Many vehicles remain unregistered due to outstanding token tax, sometimes for several years.

The department is actively conducting random checks to identify and penalize defaulters. Director Bilal Azam Khan has urged vehicle owners to comply with the tax obligations to avoid facing legal consequences.

This extension provides a final opportunity for vehicle owners to fulfill their tax responsibilities and avoid facing severe penalties.

How to Pay Token Tax in Islamabad

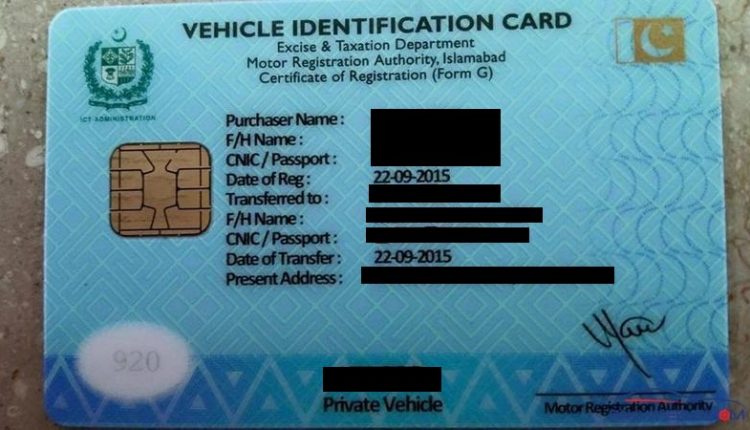

After logging into the app, users can select the Excise and Taxation department. This department provides a range of services, including online car verification, traffic challan payment, car transfer, and token tax payment. To pay the token tax, users should click on the “Token Tax” option.

This will display two options: “Pay Token Tax” and “View Paid Token Tax.” To proceed with the payment, click on “Pay Token Tax.” The system will then display a list of due token tax payments. Users can choose their preferred payment method:

- 1 BILL: This option will generate a unique PSID number for the payment.

- e-sahulat: This option will generate a tracking ID for the payment.

Users can then easily make the token tax payment through various channels such as bank transfers or ATM transactions using the generated PSID or tracking ID.

If you haven’t paid your vehicle token tax, please pay it immediately, otherwise your vehicle registration may be canceled.