In a significant move to curb token tax defaulters, the Excise and Taxation Department of Islamabad has issued a stern ultimatum to vehicle owners. Those failing to pay their token tax within 15 days risk the cancellation of their vehicle registration, beginning January 1.

The department’s advanced software will systematically identify defaulters, and after the stipulated deadline, registrations will be cancelled. Vehicle owners will then face a hefty penalty—200% of the original fine—to reinstate their registration. This harsh measure underscores the growing challenge posed by the rising number of token tax defaulters.

Director Excise and Taxation, Bilal Azam Khan, urged vehicle owners to settle their dues promptly, emphasizing the legal repercussions of neglecting this responsibility.

Field officials frequently encounter defaulters during road checks, but the nominal fines imposed in the past have failed to deter repeated violations. This new approach aims to address the loophole and establish stricter enforcement.

This initiative is also part of the Federal Board of Revenue’s (FBR) broader strategy to bridge the gap in its tax collection target. With a goal of Rs980 billion by December and a collection of only Rs775 billion in the first four months of the fiscal year, the FBR has intensified efforts to recover dues.

How To Register a Vehicle Online In Punjab?

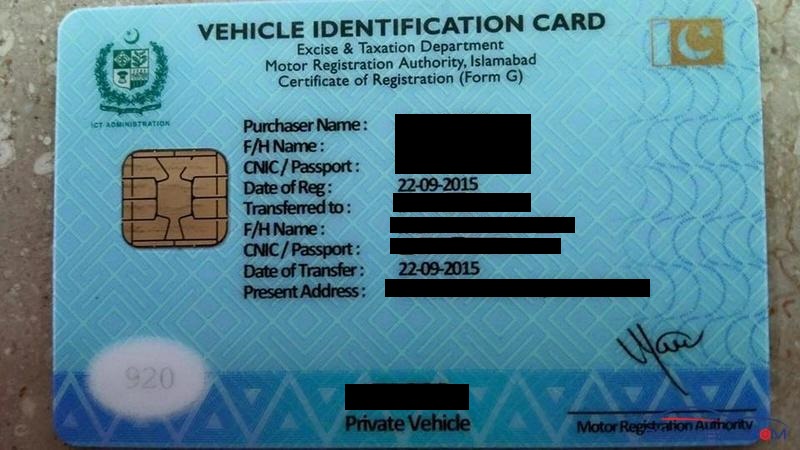

There are different documents that car owners need to register local and imported vehicles. In addition, the documents for registration of local vehicles are

- National Identity Card (NIC)

- Proof Of Ownership (vehicle invoice, sales certificate of a car or bike)

- Insurance Certificate

- Copy of CNIC of the car owner

- Vehicle Inspection certificate

The documents needed for the original purchaser of an unregistered vehicle are as follows.

- Application for the registration of a vehicle of the form F

- Copy of the CNIC of the car owner

- Original sales certificate of the vehicle

- Original sales invoice of the vehicle Bottom of Form

What do you think about the move to deal with unpaid token tax matter? Tell us in the comments section.